As we look back on the past quarter Sellers aren’t taking advantage of the strong buyer interest and putting their homes on the market. Here are some of the reasons Marin County sellers aren’t selling and our collective thinking that might allay concerns:

They can't afford to move

Depending on how long one has been in their home, taxes could be a major issue for Sellers. Sellers are allowed $250,000 profit, tax free, from their homes ($500,000 for a married couple). Above that, the excess is taxed as capital gains. One very helpful way around this is to utilize a one-time move of your current tax base to anywhere within the county. Of course, consult with your CPA to see what option is right for you and your household. Additionally, there are some reciprocal counties that will also allow Marin residents to transfer their tax base to other locations, such as Alameda, Santa Clara, and San Mateo Counties, to name a few, plus others in Southern California.

An increased base in property taxes is also of concern, and since Prop 13 has held many a tax base at a ridiculously low amount, it's hard to even buy a house for a lesser amount without paying more in taxes. Harumph! Look into some great options for tax benefits by putting your home in a trust, or creating an income property for a few years before selling and then transferring that to another income property via a 1031 exchange—maybe take some equity out of your home for a down payment on another home? There are so many options out there that it may behoove you to consult with your accountant or a tax professional.

Their kids may want to move back one day!

We all know that the price of entry in Marin County may be out of reach for our offspring in the future, and the idea of holding on to a piece of the County for them is awfully appealing; but when we look at the reality of the situation, it's not as easy a solution as we think. Statistics show that more and more Millennial are moving home to live with their parents, but to truly gift or have them purchase the family home may be too costly a proposition for most. Another idea is to help your children with a down payment in a more affordable area when they are ready; an area likely habituated also by their contemporaries, perhaps creating a new standard for living of their generation. I mean, we all love Marin, but there are other great places to to live as well! Of course, it's always great to come back home to grandma and grandpa's house, but chances are you may need to be the one traveling once your kids have their own kids.

Economic and Election Concerns

Well, sure, elections always scare us and the threat that the economy will get worse is always looming. The fact is that we can always find something to worry about in the future, but meanwhile prices keep rising (and interest rates will soon as well). So, while we're waiting, others are finding their dream replacement properties and getting on with life. Hmmmm.

Unrealistic expectations about what their house is worth—or, waiting for the market to come up to their strike price!

“It is what it is,” a wise man once told me. All the wishing and hoping in the world will not make your house worth more than what the market is willing to bear. Price it too high and you may end up getting less in the long run once it sits on the market for a while. Price it too low and you may leave some money on the table. Work with a realtor (and the key here is to listen to what they have to say) to determine the best price based on comparables in your immediate area—we're all looking at the same data and buyers are pretty savvy these days, so overpricing is uber-obvious and not well received! A realistic expectation of value and outcome is always healthier, and the best way to avoid disappointment for all.

Too overwhelming to move!

Yes, a move can be overwhelming! Packing up memories, moving logistics and just the idea of change can be daunting. Getting some kind of structure around your move can definitely help here, such as a "to do" list and timing calendar for your move, perhaps the help of an organization specialist who can help with packing what you need and disposing of what you don't. Identifying your destination and having a good handle on how that will work is also recommended. Basically, you need to put a plan in place and then work backwards on timing as it could take a while to prep your home and get it ready for market.

Waiting for kids to graduate from high school (or come back from college)

Timing is often an issue for why people wait to put their homes on the market. Kids starting or ending school is a big one. Downsizing, upsizing, changing family dynamics... all valid reasons. Couple this with not knowing what the future needs of a family will be can make even the most determined seller feel a little overwhelmed and stuck in a holding pattern. Most sellers have a clear idea of why they want to move and where they want to move. Once you get clarity on this, the idea of a move can become much more doable.

Who would want to leave Marin? Where would they go?

This one we couldn’t argue. Marin is special and anyone living here knows that. Marin is also well laid out for retirement living, so many people choose to stay in their homes rather than fleeing to wine country, Tahoe or the desert. Yet there are some wonderful retirement facilities close by that could be a great alternative for the senior set. Don’t wait too long though, as some retirement communities have age restrictions. Thinking smartly about retirement living is recommended for all. A good realtor can sit down with you and go over options, cost scenarios and the best option for you, and yes, that option could very well be staying put, but the alternatives are definitely worth exploring.

So, we all determined that there are many reasons why sellers are not so quick to pull the trigger on selling their home. But, we also agreed that when the masses finally decide to sell, buyers may not be buying the way they are now. Unfortunately, by waiting for the right signs and for others to make the move, sellers may miss their opportunity to be on the right side of the supply/demand equation and the upside vs. downside of one of the graphs below. After all, where will the sense of urgency be for buyers when they have loads and loads of homes to choose from?

That said, let’s take a look at what the Marin market was like during the third quarter, the months of July, August, and September:

The month of September alone saw a 16% increase in median sale price in Marin from the same time last year. Although there was less inventory sold during this month, the median sale price for single family homes rose to $1,191,500. This time last year, we were at a total dollar sales volume for Marin County of $862,580,674. Presently, that Q3 total sales dollar volume is at $696,961,197. Yes, this volume is definitely respectable, however, a sharp contrast from 2015’s third quarter volume. Historically, fall months of September and October bring a fresh surge of inventory to the market, but at the end of the third quarter we’re down a bit; the remainder of 2016 will probably be a weaker year than last if the downward trend continues, but smart buyers and sellers can spot this as an opportunity and do quite well.

Marin County Homes Sold Through September 2016

Graph reflecting number of homes in Marin sold in past Septembers: MAR

Single Family Homes Sold in Third Quarter 2016 VS Third Quarter 2015

The luxury communities of Larkspur and Ross saw increases in median sales prices, increasing 17% and 43%, respectively, from the third quarter of 2015 to the third quarter of this year. With slightly less inventory in both cities, they still achieved higher median sale prices, a nod to more expensive homes in higher demand (note only 6 homes in Ross this year compared to 10 last year). The other luxury communities of Kentfield, Tiburon, and Belvedere each saw decreases in both inventory and median sale prices.

The most expensive home sold in Marin in September was 124 Madrona Avenue in Belvedere, which sold for $5,000,000 after 175 days on the market.

On the other hand, San Rafael, San Anselmo, Mill Valley, Novato and Corte Madera each had a successful third quarter, with homes sold in San Rafael achieving a median home sale price of $1,010,000, up 7% from last year’s $945,000. San Anselmo saw an impressive 14% sales price growth, surpassing its 2015 third quarter median home price of $1,054,000 to a whopping $1,200,000. The most homes sold during the third quarter were in Novato, an area where we are seeing more remodeled homes, mainly single family ranchers with new finishes and freshly landscaped yards. With 123 homes sold in the third quarter alone, Novato is on the radar in the Marin housing market as a still relatively affordable area, with access to open space, good schools, and plenty of options for buyers that include homes that are fabulously re-vamped but more modestly priced versus Southern Marin.

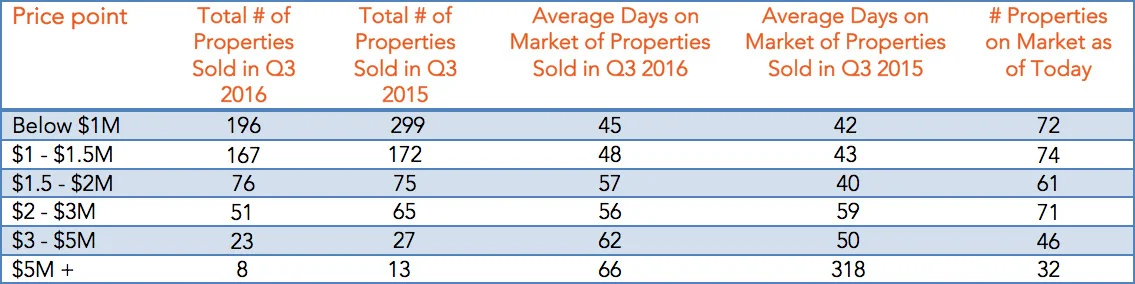

Trends of Homes Sold in Marin in Varying Price Ranges

n interesting trend to note in the graph above, is in the third quarter of 2016, as the price of homes grow, so does the average days on market (DOM). This increase in the time of a home on the market could be attributed to buyers being more conscious and careful about making the decision to go ahead and buy, reflected by the additional time a property sits on the market. Apart from the $1.5-$2 million range, more homes sold in all ranges in 2015. We are still seeing a fair number of homes under $1 million available in the third quarter, with 196 sold in 2016; a nod to the Marin market still offering choices for buyers with a budget of $1 million. We are also seeing a 42-45 average DOM with this group of homes, attributed to the fact that once buyers see a great home with an affordable price, they take action! From the above chart, we can see that the market for homes $2-$3 million and above has cooled slightly, most notably illustrated in the number of homes sold in Q3 2015 and the number of homes sold in Q3 2016, a difference of 14.

The most expensive home sold in Marin in July, August, and September was 170 Laurel Grove in Ross, which sold for $8,745,000 after only 28 days on the market

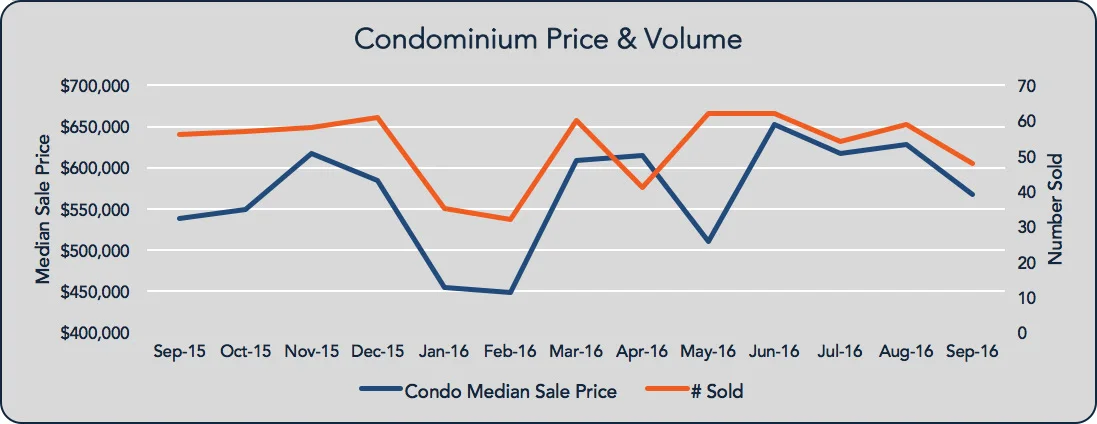

Price and Volume of Condominiums Sold in Marin

he Marin condominium market was relatively prosperous this quarter, with 167 condominiums sold, and a median sale price of $599,000 over the months of the third quarter. The average days on market for the third quarter was 56. Last year’s third quarter median sale price for condominiums was $555,000, a respective $44,000 less than this year’s. At a significantly higher selling price than this quarter last year, this could mean that prospective Marin homebuyers are opting for a less expensive investment by seeking a condo rather than a single family dwelling. This still gives them a Marin zip code and access to Marin public schools, but at a lower price of entry, while enjoying the same perks as other Marin homeowners. As of this writing, there are 111 condominiums on the market in Marin, 21 of which are brand new; a good indication of a strong condo market in our county.

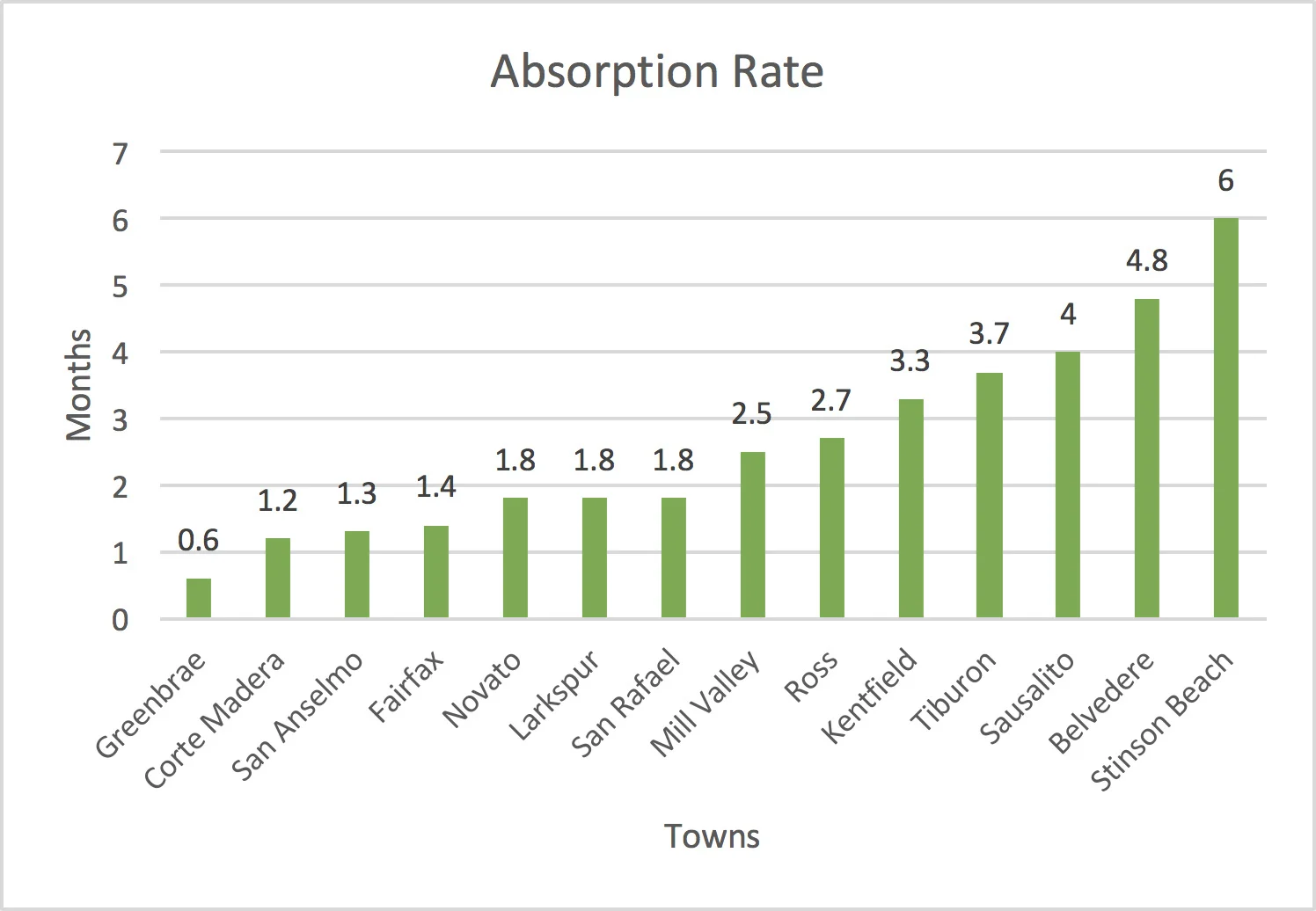

Absorption Rates for Marin Towns Based on Data from Q1-Q3

An absorption rate is a number signifying the rate at which homes are selling in a specific area, and helps us determine where markets are hot. We calculated the absorption rate for each Marin town based on Third Quarter single family home market data (data representing January 1st through September 30th, 2016). If market conditions remain constant and no new listings come on the market, then it will take a certain amount of months for the current inventory in each town to sell at the market’s current pace. In other words, it is the rate at which a market absorbs its inventory. Markets are ever-changing; new inventory is added and old inventory is sold and absorbed, but a balanced market’s absorption rate is typically considered to be between 5-7 months. And, generally speaking, the lower the absorption rate, the hotter the demand is for that area. Overall, the Marin absorption rate is 2.25 months worth of inventory.

Carole Rodoni is a renowned real estate and economic speaker. She has an amazing sense of the worldwide market and how local real estate is affected by various aspects of the global economy. Some key items impacting our current real estate market include the jitters surrounding the upcoming election next month, more conservative trends of buyers, and more urgency in the high-end luxury market. Rodoni projected an opening up of the market after the election – once voters are past the November mark, we may see things begin to normalize again, and maybe the hesitation on behalf of many buyers – and sellers – will be eliminated.

Some trends to note about buyers is that they are tired of playing the real estate “game;” exhausted by the multiple offer scenario of which we have seen so much. “Why wouldn’t you buy now?”, Rodoni asks. Rates are low; and even if they’re raised by just one fourth of a point, it’s really nothing to be worried about, as it won’t have that much effect on the market. She encouraged buyers to keep in mind that now is a perfectly appropriate time to purchase, because between low rates, the fact that you’re collecting an asset that will eventually bring a return, and bring a tax deductible interest and $250-$500,000 of tax-free appreciation, now is a great time to buy! Considering also, as Rodoni states, we are now within 4% of the peak of the market. Things are definitely looking up, so she encourages buyers to purchase while they still can!